Market Headlines – 6/2/2018

US

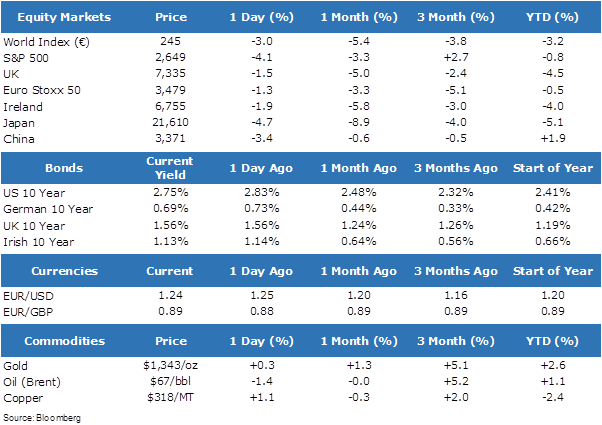

- US equities had a volatile session yesterday, extending weakness from Friday’s session by closing a further 4.1% lower. While all 11 sectors finished in negative territory, Financials and Health Care contributed the most losses for the session.

- The VIX index, a measure of implied equity US market volatility, rose to 35.3 yesterday, levels last experienced in August 2015.

- US bonds, however, found a degree of support on Monday, with the 10-year yield down 8bps to 2.77%. In commodity markets, oil prices was also caught up in the risk-off session, falling 1.4% to settle at $67 a barrel.

Europe

- European equities also experienced a negative session. The Euro Stoxx 50 index fell 1.3%, the German DAX index lost 0.8% and the French CAC index settled 1.5% lower.

- Futures indicate a weak open again this morning for Europe.

Asia

- Asian equities took the lead from their US and European peers overnight, with Japanese markets trading 4.7% lower and Chinese stocks losing 3.4%.

Market Performance: