Market Headlines 25/9/2017

US

- The S&P 500 closed marginally higher on Friday, with Telecoms and Energy leading gainers, despite North Korea’s threat of testing a hydrogen bomb over the Pacific Ocean.

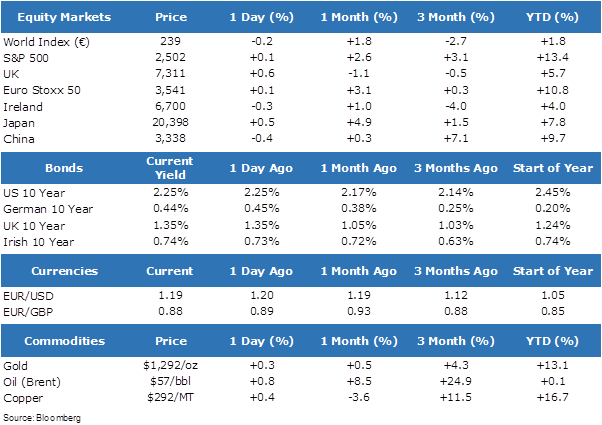

- US bond yields were slightly firmer for the session, as the yield on the 10-year Treasury bond fell to 2.25% (prices rose) after posting a strong rebound in recent weeks. Since lows around 2% two weeks ago, the yield on the 10-year has added more than 23 basis points over the period, notching further gains after the Fed announcement on Wednesday.

- Central banks could offer further direction to markets this week as Mario Draghi addresses EU lawmakers in Brussels later today, Janet Yellen has a speech in the US on Tuesday and Bank of England Governor Mark Carney also has a speech scheduled for later in the week.

Europe

- European equities broadly tracked the performance of their US peers Friday, settling marginally higher. The UK’s FTSE 100, however, jumped 0.6% following a speech from Prime Minister Theresa May which gave little detail on how she wants a Brexit transition period to work. Sterling fell against the dollar on the speech, potentially boosting revenues at large UK firms that deal in dollars.

- The euro dipped 0.2% against the dollar this morning following the disappointing yet overwhelming victory for German Chancellor Angela Merkel in yesterday’s election. Coalition deals are likely to be more difficult after the result as Merkel won a smaller share of the vote than expected, with focus on a surprisingly strong result for a far-right party.

Asia