Market Headlines – 21/5/2018

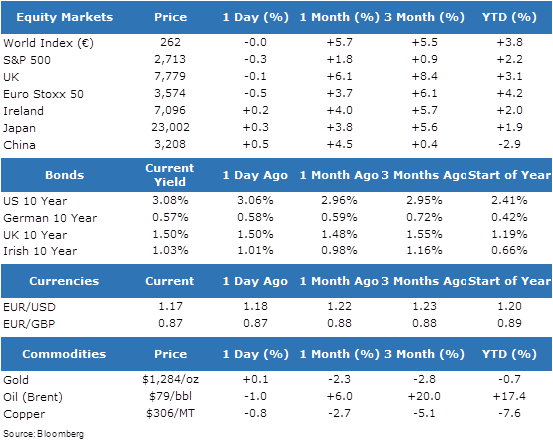

- US stocks closed marginally lower on Friday as ongoing trade negotiations between the US and China weighed on sentiment. The S&P 500 fell 0.3% as losses in Financials and Energy offset gains elsewhere.

- Semiconductor stocks were among the primary underperformers as weak guidance from Applied Materials, a maker of equipment used to produce chips, weighed on the sector.

- Bond yields remained in focus as the US 10 year traded above 3.1% for the first time since 2011 and the 2 year bond touched its highest level in a decade. US yields settled at 3.08% on Friday.

- European equities also closed lower amid trade concerns. The Euro Stoxx 50 index fell 0.5%, the German DAX index lost 0.3% and the French CAC settled 0.1% lower.

- Futures indicate a positive open in the region of +0.4% this morning following comments from US Treasury Secretary Mnuchin that the US was “putting the trade war on hold” amid progress in talks with China.

- In currency markets, the euro touched fresh lows for the year after Italy’s two populist parties agreed on a prime minister.

- Asian markets began the week on a positive note this morning. Japanese stocks gained 0.3% and Chinese stocks settled 0.5% higher.

Market Performance: