Market Headlines 12th July 2017

US

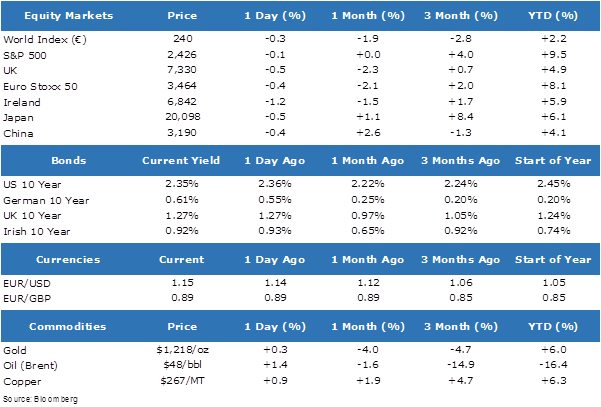

- Fresh concerns about the Trump campaign’s involvement with Russia during last year’s presidential election helped fuel a brief bout of selling on Wall Street that took the S&P 500 down as much as 0.6 per cent intra-day. However, the US equity market benchmark settled just 0.1% softer by the close of trading, as strength for the energy sector helped limit losses. Technology stocks also outperformed.

- US bonds continued to recoup some of their recent losses, as 10-year yields settled 1bps lower. The US dollar, however, experienced further losses against the euro, trading 0.4% lower and settling at $1.1439.

- Focus will now turn to Federal Reserve Chair Janet Yellen’s semi-annual testimony to Congress over the next two days. Markets will be closely watching for any comments on inflation given the central bank’s view that subdued price pressures will prove temporary.

- US producer and consumer price inflation data is also due on Thursday and Friday this week.

Europe

- European equities broadly underperformed their US peers yesterday, with the Euro Stoxx 50 index falling 0.4%. European bond markets also experienced further weakness, closing 1-2bps higher across the board.

- Crude oil prices staged a strong intra-day recovery, settling 1.4% higher having been 1.5% lower at one point during the session.

Asia

Japanese equities closed 0.5% weaker, with all 11 sectors settling lower, after the Yen gained 0.5% against the US dollar, its largest single day gain in 3 weeks.