Market Headlines 12/9/2017

US

- The S&P 500 Index rose the most since April, gaining 1.1%, closing at a record high. The move came after hurricane Irma weakened and North Korea refrained from an expected missile test.

- The yield on the US ten year rose to 2.14%, its biggest one day jump since January. Yields have come under pressure in the US recently due to decreased market rate hike expectations.

- The dollar also gained yesterday with the EURUSD rate falling back below the $1.20 level.

Europe

- European equities gained for a fourth day, rising 1.4%, the longest winning streak for the index since mid-July.

- All 19 industry groups gained with insurance stocks leading the charge, rising 2.3%, after a weakened hurricane Irma helped relieve concerns.

Asia

- Asian equities extended gains, with Japanese and Chinese equities rising 0.3% and 5.2% respectively. The move came after U.S. stocks rose to a record as Hurricane Irma wreaked less damage than forecast and the United Nations’ sanctions against North Korea weren’t as stringent as expected.

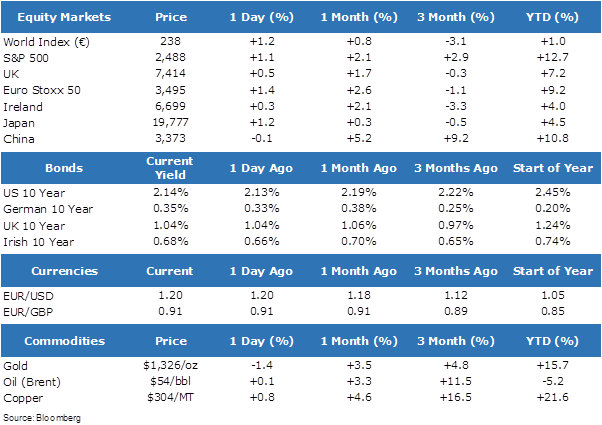

Market Performance