Market Headlines: 10/07/2017

US

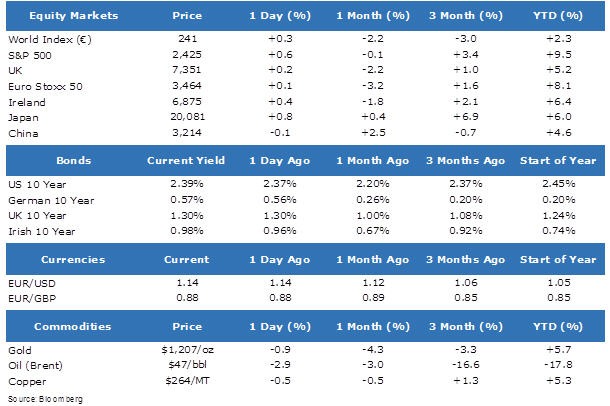

- Equity markets in the US finished last week on the front foot. The S&P 500 closed 0.6% higher on Friday following the broadly positive employment report, with tech stocks leading gainers.

- Friday’s employment report highlighted strong employment growth in the US last month (222k jobs added in the month versus expectations of 178k). However, wage growth, a key driver of inflation, remains elusive, coming in at +0.2% month-on-month versus expectations of +0.3%.

- US bond markets were relatively unmoved on Friday. The yield on the 10-year Treasury moved up 2bps (prices fell) to close at 2.39%. The US dollar gained 0.2% Friday while Gold fell 1%, reaching its lowest level since March.

- Key data releases this week include US inflation readings on Thursday (CPI – Consumer Price Index) and Friday (PPI – Producer Price Index), German and French inflation readings (both Thursday), and US retail sales numbers on Friday.

Europe

- European equity markets were little moved on Friday as the Euro Stoxx 50 index settled a modest 0.1% higher. However, for the week the index did gain 0.7% and so snapping a run of four weeks of consecutive declines.

- European bond markets were a little bit more mixed on Friday following positive industrial production data releases. Yields on German 10 year bonds rose modestly (prices fell), outperforming the periphery which finished 6-9bps higher, led by Portugal after they pushed back a bond auction to this week.

Asia

Japanese equities gained 0.8% this morning, boosted by a weaker Yen. Tech (+1.8%) and Real Estate (+1.5%) led the index higher.