Market Headlines 23/8/2017

US

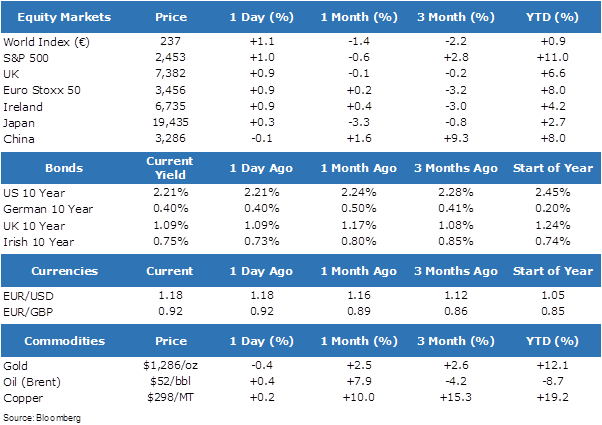

- US stocks and the dollar rebounded yesterday as an absence of further negative news from the Administration in Washington DC and a lull in tensions between the US and North Korea encouraged a more risk-on mood.

- The S&P 500 gained 1.0%, with Technology and Materials stocks providing the most gains. Energy stocks were also boosted by a robust session for oil prices which rose after a 2.0% slide in the previous session.

- The dollar reversed recent weakness, gaining 0.5% against a basket of currencies. The greenback traded 0.5% higher against both the euro and sterling respectively.

- The positive session for risk assets was also evident in fixed income markets as the US 10-year yield rose 3bps (prices fell) to 2.21%.

Europe

- European equities also rebounded from recent weakness, with the Euro Stoxx 50 index settling 0.9% stronger. Euro weakness boosted the export-heavy German DAX index which gained 1.4%.

- European bond yields also traded higher yesterday (prices fell) with the most action in Italian government bond yields which traded 7bps higher to 2.10%.

- Flash PMIs – Purchasing Managers’ Index: a key barometer of growth in an economy – are due to be realised in Europe today. Growth has been robust on these measures over previous months and are likely to be the key areas of focus today before the central bank symposium in Jackson Hole, Wyoming, tomorrow.

Asia

A muted session in Asia overnight, with Japanese equities settling marginally higher and Chinese stocks marginally lower.

Market Performance: