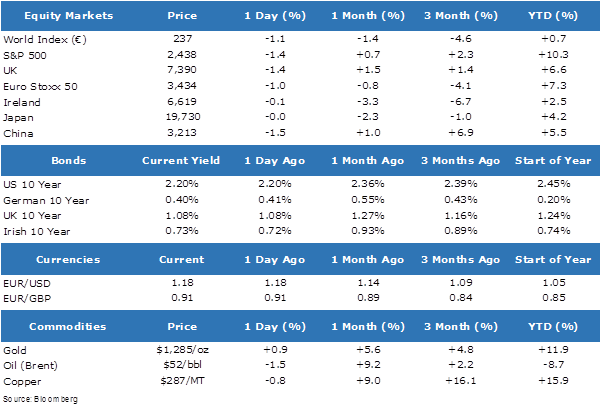

Market Headlines 11/8/2017

US

- US. stocks declined, falling 1.4%, as geopolitical tension between the U.S. and North Korea continued to sap global equity markets.

- In economic news, US inflation data will be released today. U.S. inflation has missed estimates for four months in a row, but July may have broken the streak. The market will be focused on the latest inflation print for an indication surrounding when the Federal Reserve will resume raising interest rates.

- Oil declined 1.5% yesterday following rising investor scepticism over whether OPEC-led production cuts are draining a global glut fast enough, weighing on prices and driving crude toward a second weekly loss.

Europe

- European equities fell for a second day, falling 1%, as geopolitical tensions between North Korea and the U.S. persisted.

- Banking sector stocks retreated the most in more than three weeks, falling 1.5%

- Basic Resources stocks also came under pressure following weakness in the oil price, falling 0.5%.

Asia

- In Asia overnight, Japanese stocks were unchanged despite strong moves in the yen. The yen rose to the strongest in eight weeks against the dollar after U.S. President Donald Trump intensified warnings to North Korea, triggering demand for safer assets.

- Chinese equities fell 1.5% as the yuan fell the most since January after the central bank set its fixing for the currency weaker than the market expected.

Market Performance