Retirement Planning

We believe that your lifestyle should improve once you retire. MBC Financial will give you the best advice and supporting plans to achieve this.

-

Retirement Planning Advice Cork

Retirement planning can be a daunting task. It’s never too early to start thinking about your retirement, and we can help you do it right. You deserve the best possible future, which is why we want to make sure you have all the information necessary before making any decisions about your retirement funds. We have the expertise and experience to guide you through the process of finding the best plan for your needs. You deserve a comfortable retirement, so let us take care of all that complicated paperwork for you. Our team will work with you one-on-one to find out what is best for your situation and make sure everything is taken care of in time. Let us worry about all those pesky details while you enjoy life.

Click here to read about our process on how we work with clients to design the best pension plan that suits them.

I have been with MBC Financial for many years, managing my pension fund and investments, their professional knowledge in the industry, advice and guidance has been excellent. As a self employed Engineer, I have confidence in MBC financial and would recommend them to anyone looking for financial advice on investments and pensions.

Testimonial from Mark N.

-

How Pensions Work

Every month, over a number of years you can allocate some money from your wages into your retirement fund. You can start a pension at any age but the earlier the better. Your pension contributions are put into a fund and they are invested on your behalf. The aim of this is to grow your savings over time and beat the amount you’d make from leaving it in the bank at a very low or even negative interest rate. In the end what you want is to have enough money at retirement to live without financial worries for the rest of your life.

A pension or retirement plan is just a long term savings plan but you may get tax relief on these savings. The Government wants and encourages people to invest in a pension so they offer tax incentives to put this money away and leave it untouched.

Any gains from your pensions are also reinvested over months and years, depending of course on how your investment and the markets perform. Small amounts invested as early as possible can become large amounts by retirement age. You can invest in a pension at any age but to reach the amount you need for retirement you would have to invest larger amounts depending on how late you leave it.

-

Personal Pension Plan

Quite simply a Personal Pension Plan (PPP) is an extremely tax efficient to save for retirement. This structure is suitable for self employed people (sole traders or partners) and people who are in employment but have no pension provided by their employer.

At MBC Financial we can advise our clients on the eligibility and suitability of an PPP for certain individuals. We also provide ongoing advice on investment choice and funding capacity by keeping our clients up to date on changes in revenue rules and legislation that will affect them.

How a Personal Pension Plan works.

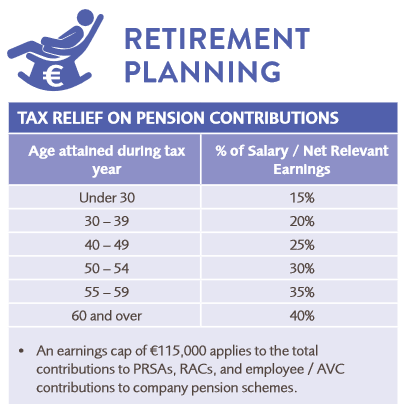

Once we set a realistic target and select the most suitable plan the client decides what they want to and can contribute. Currently there is full income tax relief available on pension contributions. However this may change in the future. The maximum amount a person can contribute is as follows

Investment Choice

Until recently pensions were simply invested in a “Managed Fund”. In most cases the beneficiary knew little of the actual investment and had no control over how his/her money was invested.

The options now include traditional managed funds, sector and geographic funds, term deposits, individual stocks and tracker bonds. At MBC Financial we work closely with our clients in helping them select the most suitable investment.

Target Amount

Once we establish your expectations for income in retirement we will work with you to set realistic goals. We will then put the most suitable plans in place to make these goals achievable.

-

Pensions with Previous Employer

If you have an old pension with a previous employer you have a number of options.

Leave the pension with the previous employer. However, as Trustees, the former employer retains investment control over the scheme and is the point of contact for the administrator and fund manager.

Transfer the fund to a Personal Retirement Savings Account (PRSA). This is a simple contract and additional contributions can be made to it. However the means by which you take your benefits may be restricted.

Transfer the fund to a Buy Out Bond. This severs the tie with the former employer and give you complete investment control. Also there is no change in how you take you benefits at retirement. Read more on Pension Transfers.

Transfer to a new employer sponsored scheme. This simply consolidates the old and the new schemes and does not compromise how you take your benefits.

There are several factors that will need to be taken into account before a recommendation is made.

These include

- Age

- Retirement Age

- Salary (current and previous)

- The nature of the old scheme

- To decide on the best option for you please contact us for a consultation.

-

Executive Pension Plan

An Executive Pension Plan (EPP) is an extremely tax efficient way for an employer to provide retirement benefits to its owners and senior employees

How an EPP works

The employer decides the amount of contributions to be paid into the scheme. This can be increased through tax deductable Additional Voluntary Contributions (AVCs) by the scheme member.

Good for employee

The key benefit for the scheme member is that all payments into each pension plan are not taxable, although tax may be payable when drawing down the fund. However, with careful planning, this liability can be minimised.

Good for employer

Since payments into Executive Pension Plans are treated as expenses, they reduce profit and thereby reduce the corporation tax liability too. Of course, a good EPP is also an excellent way for the company to retain its best personnel.

More choice when it come to your investment

Until recently, most pensions were invested in a ‘Managed Fund’. This gave little control over how the investment was controlled. At MBC Financial, we work closely with our clients to help them select the most suitable investment vehicle from a range of options such as traditional managed funds, sector and geographic funds, term deposits, individual stocks and tracker bonds.

MBC Financial will be happy to advise on all aspects of an EPP scheme, including eligibility criteria upon request. We can also advise on your investment choice and funding capacity by keeping you up-to-date on changes in legislation and revenue rules.

-

Occupational Schemes

These are schemes that are set up by an employer for a group of employees. The employer effectively sponsors the scheme by making contributions for the employee who in turn can make contributions also.

There are two types of Occupational Schemes:

Defined Benefit Schemes / Final Salary Schemes

Also know as Final Salary schemes these promise to provide an income for life for a member depending on his/her final salary and years of service. For example if an employee had 30 years service and had a final salary of 40,000 the pension promise may be 1/60 of salary for every year. In this case the pension promise would be 30/60 x €40,000 = €20,000 per annum.

Defined Contribution Schemes

These are more common now as the cost of Defined Benefit scheme for employers has become almost prohibitive. Effectively the employees benefits depend entirely on the fund value and the pension that they can expect depends on prevailing annuity rates and whether or not they want to provide a pension for their spouse after they die.

In both these cases the Trustees of the scheme are obliged to provide you with an Annual Benefit Statement and a Statement of Reasonable Projection.

At MBC Financial we can work with employers and scheme members to ensure the scheme in place is efficient, transparent, cost effective and accessible.

To do this we provide investment advice on schemes, to both members and Trustees, as well as online access. A summary of the services we provide are:

- On-line access system – Pension Planet Interactive. Employer access and member access.

- Data download facility – Interfacing with the companies payroll provider for submitting pension contributions.

- Pension Pulse – Funding reports for members. Comprehensive member education.

- Lifestyling – Personal Lifestyle strategy – which takes care of members investment throughout the whole term of the policy.

- Biggest and best performing fund manager in the Irish market.

- Client services manager to attend annual trustee meeting.

- My Pension smartphone app available to members

-

Post Retirement

How you take your benefits depends on several factors.

These include:

What structure you used to accumulate your pension fund

- Fund Value

- Final Salary (if employed)

- Years of Service with employer

- Age

- Your income requirements

- At MBC Financial we will look at the various choice facing you and make a recommendation on which will suit you and your family best.

The following is a list of options. Some or all of these may be open to you depending on the factors outlined above.

Annuity

This is where you purchase an income for life from an insurance company. You are guaranteed a set income that can be level of index linked. Once entered into the annuity cannot be altered and you will have no access to your capital. The older you are the better the annuity rate will typically be.

Approved Retirement Fund (ARF)

This is an alternative to an annuity where you can withdraw funds as required. You retain full investment control. However the main risk here is “bomb out” whereby you use all your fund so that later on in life there is no additional income available.

Approved Minimum Retirement Fund (AMRF)

The requirement for an AMRF ceased on January 1st 2022

Tax Free Lump Sum

This can be taken in two forms. Salary Dependent: The tax free lump sum can be a maximum of 1.5 times salary dependent on years of service. This is open to both employees and company directors. Fund Dependent: The tax free lump sum is a maximum of 25% of the value of your fund and is capped at €200,000

Depending on your fund value, employment status and the source of your pension you may have access to all or a combination of the above structures. The important point to note is that you only make your decision on how you draw your benefits when you retire. In the mean time it is important to build a meaningful fund to give yourself these options.

Click here to read about our process on how we work with clients to design the best pension plan that suits them.