Market Headlines 13/07/2017

Market Headlines

US

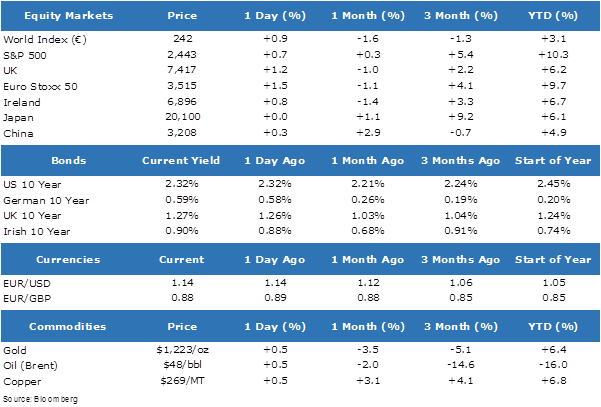

- US equity and Treasury prices rose (yields fell) as markets digested dovish comments from Fed Chair Janet Yellen yesterday. The S&P 500 closed 0.7% higher, with Technology and Real Estate contributing the most gains.

- The Federal Reserve chair said US policymakers were watching inflation very closely given its failure to pick up to the central bank’s target, but she offered no fresh clues on the timing of the next rate rise or when the central bank would begin reducing its balance sheet.

- The US dollar put in an overall mixed session yesterday, rising 0.2% against the euro but declining 0.7% against the Japanese yen. The dollar index ultimately gained 0.1% against a broad basket of peers.

- The Canadian dollar, meanwhile, rose sharply after the Bank of Canada raised rates 25bp to 0.75 per cent — the first increase in seven years and a partial reversal of the 50bp of cuts made in 2015 in an effort to offset the impact of the oil price shock.

Europe

- European equities enjoyed a more positive session than their US peers. The Euro Stoxx 50 index gained 1.5%, the UK’s FTSE 100 rose 1.2%, and the French CAC, German DAX and Italian FTSE MIB all added between 1.5%-1.6%.

- Oil prices continued to bounce off recent lows following positive US inventories data. Brent settled 0.5% higher for the session and is now 6.5% above the low touched in mid-June.

Asia

Asian equities were more muted than their US and European counterparts in the previous session. Japanese equities closed broadly unchanged as the Yen added 0.2% against the dollar.