Corporate Saving and Investment Solutions

Corporate Saving and Investment Solutions

When you have extra funds on your balance sheet, is cash the best option? While holding money in deposit can be useful for meeting short-term cash flow needs, relying solely on cash deposits may not be the most efficient way to manage your surplus cash. In fact, it can have a negative impact on your balance sheet, such as:

Interest rates on deposits remain low, with the highest available five-year fixed term deposit Annual Equivalent Rate (AER) at only 1.25%.

Meanwhile, Ireland’s annual inflation rate has risen to 7.8% year-on-year as of January 2023. This means that returns on deposit accounts are not keeping up with inflation, causing the real value of your balance sheet to decrease over time. In other words, inflation is eroding the purchasing power of your money on deposit, making it less beneficial to hold onto surplus cash.

Looking for a better solution for your company’s surplus money? Talk to Alan and Team at MBC Financial about Aviva’s Corporate Investment Bond or Corporate Savings Plan. With these options, your surplus money can be invested in funds that match your desired risk profile, offering greater potential for growth, especially in the long-term. Aviva provides access to a wide range of funds across different risk levels, asset classes, and from leading global fund managers.

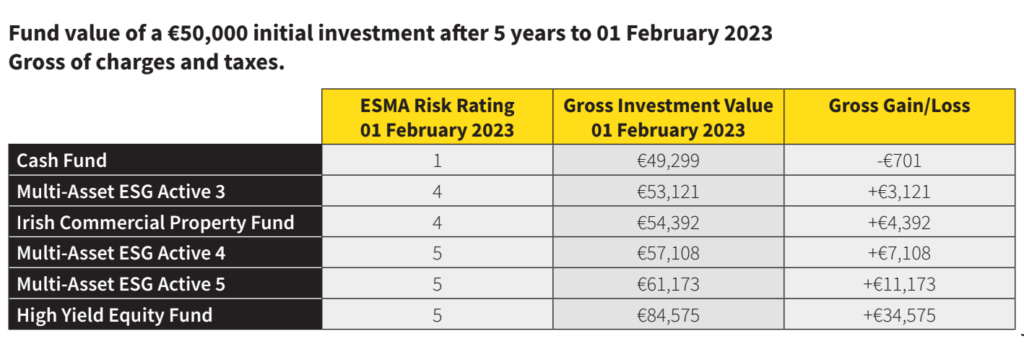

As shown in the table, lump sum investors in Aviva’s popular funds have achieved strong returns over a five-year period. So, contact Alan and Team at MBC Financial today and take the next step towards maximising your company’s financial potential.

Download the Corporate-Investment-Customer-Flyer

You can get a comprehensive list of available funds and their performance by contact Alan and Team in MBC Financial.

MBC Financial and Aviva Corporate Investments provide a wide range of sustainable investment options. Choose from different ways to invest, with varying risk levels, including ready-made multi-asset funds or custom portfolios created with your Financial Broker. Our funds are designed with responsible investing principles in mind, allowing your company’s money to make a positive impact on the world while also potentially providing financial rewards.

MBC Financial and Aviva Corporate Investments offer flexible products with easy access options. Choose from two products:

- A Savings Plan allowing you to save as little as €250 per month and make a lump sum at outset

- An Investment Bond with a minimum investment of €10,000 and the flexibility to take regular withdrawals

Aviva is a trusted provider with around 18.5 million customers worldwide and is one of Ireland’s leading financial services companies, employing 1,500 people across three locations.

Looking for expert financial advice? Let MBC Financial help you! The first meeting is at our expense, so you have nothing to lose by filling out our query form. Don’t just take our word for it – read our client testimonials to see what people think about our work.

MBC Financial is regulated by the Central Bank of Ireland.