Market Headlines 2/10/2017

US

- The S&P 500 added to recent gains on Friday, gaining 0.4% as Technology companies outperformed, bringing the gain in September for the US large-cap index to 2.1%.

- Gains for the week were propelled by the unveiling of a tax reform plan that aims to reduce the US corporate tax rate from 35% to 20%. If passed through Congress, this would provide a tailwind for corporate earnings.

- Economic data releases on Friday were mixed as inflation data missed expectations while measures of economic activity remained robust. Treasury yields rose following the data and amid news that President Trump met with Kevin Warsh, a former Federal Reserve governor, to discuss the Fed Chairman position.

- The US jobs report this Friday is likely to be the main event for the week ahead. Consensus is expecting the US economy to have added 100,000 jobs in September, down from 156,000 jobs in August, as the data is likely to be distorted by the impact of Hurricane Irma in the early part of the month.

Europe

- Stocks in Europe also closed higher Friday as most sectors settled in positive territory. The Euro Stoxx 50 index gained just shy of 1% and the UK’s FTSE 100 closed 0.7% higher.

- The euro has dipped around 0.4% to $1.1758 in early trade this morning after a contentious vote in Catalonia on whether to split from Spain, an event which was marred by violence. Although the referendum is not legally recognised by the Spanish government, the outcome will place pressure on PM Rajoy’s administration.

Asia

- Chinese PMI (Purchasing Manager Index) data released over the weekend was stronger than expected, with the index hovering at five and a half year highs.

- The reaction in Asian markets this morning, however, has been muted as Chinese indices are closed for the week. Japanese stocks did close marginally higher as gains for Consumer Discretionary and Industrials offset weakness in Energy and Real Estate companies.

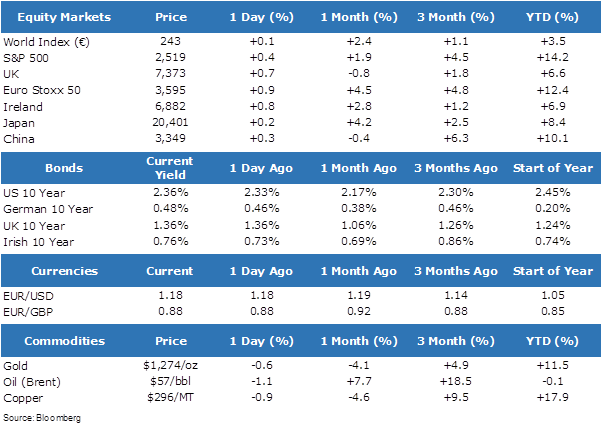

Market Performance: