Market Headlines – 15/6/2018

US

- US equities gained 0.2% yesterday with the S&P 500 climbing for the 4th day in 5, after the Federal Reserve delivered a modestly hawkish decision Wednesday and the European Central Bank signaled a somewhat dovish tone. Large technology and media companies drove gains.

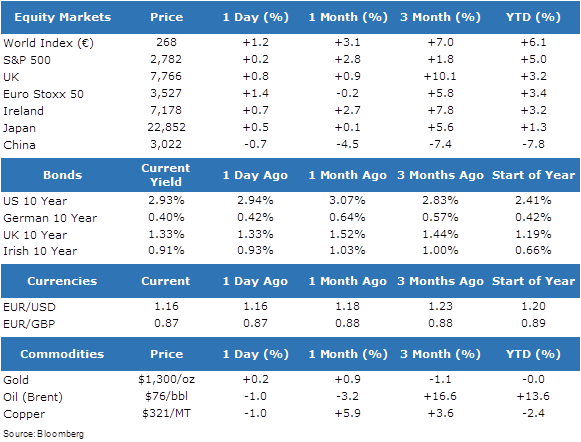

- The dollar gained against the Euro, hitting an 11-month high. US 10-year Treasury yields declined to 2.93%.

Europe

- European stocks increased 1.4% as ECB President Mario Draghi succeeded Thursday in announcing the phasing out of quantitative easing without roiling markets.

- The ECB will reduce monthly bond purchases from the current run rate of Euro 30bn to Euro 15bn a month in the fourth quarter before ending in December. In addition it is unlikely there will be an interest rate hike until the second half of 2019. The Euro suffered its biggest drop in about two years and major government bonds rallied.

Asia

- Asian shares traded mixed overnight. Japanese shares gained 0.5% after the BOJ left monetary policy unchanged and downgraded its assessment of inflation.

- Chinese shares fell 0.7% as the U.S. prepared to release a list of goods upon which it will impose trade tariffs.

Market Performance