Market Headlines – 24/4/2018

US

- US. stocks were little changed, with the S&P 500 ending the day virtually flat amid the slowest trading this year.

- In currency news the dollar rose to its highest level in more than three months as the prospect of yields on benchmark U.S. Treasuries reaching 3% reignited demand. The greenback strengthened against major peers as the yield on the U.S. 10-year note hit 2.99 % for the first time since 2014 before paring the increase.

Europe

- European equities advanced 0.5% with Insurance and Banking stocks leading the gains.

- In other news, economic momentum in the euro area kept a steady pace in April after softening earlier in the year, in a sign that growth in the region is set to continue albeit at a slower pace. A composite Purchasing Managers’ Index remained unchanged at 55.2. Economists predicted a decline to 54.8. While activity in services picked up, growth in manufacturing slowed to the weakest in more than a year.

- Economic news is a key focus this week as the European Central Bank has a rate decision on Thursday. Investors will watch for any sign that officials are preparing a shift in stimulus plans for their June meeting.

Asia

- Equities in Japan rose reaching at the highest in almost two months following declines in the yen.

- Chinese shares advanced on signs the government is moving to ease some policies that it had sought to rein in a credit binge in some parts of the economy.

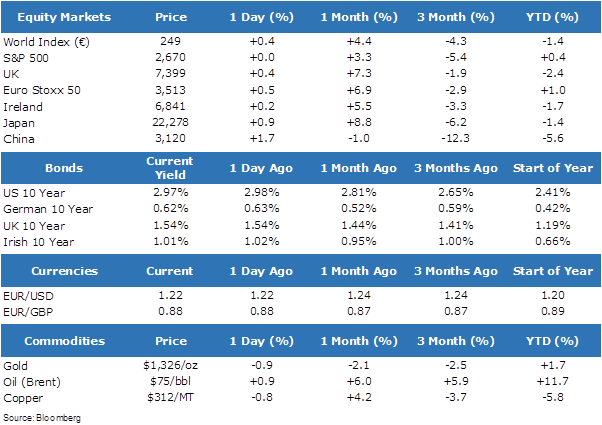

Market Performance: