Market Headlines – 11/4/2018

US

- US stocks closed sharply higher yesterday following a speech from Chinese President Xi that eased trade concerns. The S&P 500 traded 1.7% higher with gains broad based across sectors.

- Chinese President Xi Jinping discussed plans to further open up the country’s economy, with measures including lowering import tariffs on autos, enforcing legal intellectual property of foreign groups and reducing duties on other consumer products.

- Energy stocks were among the best performers Tuesday, tracking oil prices strong 3.5% gain.

- US consumer price inflation data is likely to be the main area of focus for markets today. The minutes from the Federal Reserve’s last policy meeting are also set to be released.

Europe

- European equities also received a boost from easing trade concerns. The Euro Stoxx 50 index gained 0.7%, the German DAX index rose 1.1% and the French CAC settled 0.8% higher.

- Basic Resources companies, who have sizeable exposure to Chinese demand, were also among the best performers in Europe, rising 3%.

Asia

- Asian equities were more mixed overnight following strong gains in the previous session. Japanese stocks fell 0.5% while Chinese equities settled higher.

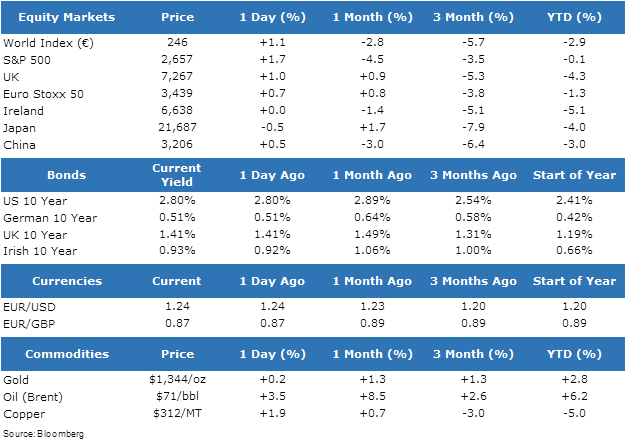

Market Performance: